Economists and investors watch various economic indicators when predicting recessions and market downturns . One such indicator that has gained significant attention is the inverted bond yield. In this article, we’ll explore what inverted bond yields are, their relationship to recessions , and why they are crucial in assessing the economic landscape.

An inverted bond yield occurs when short-term government bonds surpass long-term bonds’ yield. This phenomenon is seen as a sign of economic uncertainty and a potential warning of an impending recession. Historically, inverted bond yields have preceded most major recessions , making them an essential tool for economists and investors.

The logic behind the inverted bond yield indicator lies in the behavior of investors during uncertain times. When there is fear of an economic downturn, investors tend to move their money into safer long-term bonds, driving down their yields. This increased demand for long-term bonds causes their yields to fall below short-term bonds, resulting in an inversion of the yield curve . Since investors are willing to accept lower yields in exchange for the security of holding long-term bonds, this move reveals their concern about the future state of the economy.

Key Takeaways:

Understanding the Yield Curve and Economic Health

When assessing a nation’s overall economic health, one crucial indicator that economists pay close attention to is the yield curve . The yield curve not only provides insights into the current state of the economy but also serves as a predictor of future economic conditions. By understanding the dynamics of the yield curve and its relationship with economic health , investors and policymakers can make informed decisions and anticipate potential market trends.

Concept of Yield Curve Slopes

The yield curve represents the relationship between bond yields and their respective maturities. It visualizes the interest rates offered by different bonds with various maturity dates, ranging from short-term to long-term. Plotting these rates on a graph allows us to observe the pattern formed by connecting the points, resulting in a yield curve.

The slope of the yield curve is a critical aspect to consider. In a standard yield curve , the longer-term bonds tend to have higher yields than the shorter-term bonds. This upward-sloping curve indicates market expectations of economic growth and inflation . Conversely, an inverted yield curve occurs when short-term bonds yield higher returns than long-term bonds. An inverted yield curve is seen as an alarming sign of potentially deteriorating economic conditions and the possibility of a future recession.

Normal vs. Inverted Yield Curve

The average yield curve , with its upward slope, reflects a healthy and expanding economy. It signals investors’ optimism about the future, as they demand higher returns for committing their funds for longer durations. This curve indicates that investors expect interest rates to rise gradually over time.

On the other hand, an inverted yield curve , where long-term bond yields are lower than short-term bond yields, raises concerns about economic contraction. Investors’ behavior suggests their anticipation of an economic downturn and the possibility of interest rate cuts by the central bank.

Understanding the nuances of yield curve slopes in standard and inverted scenarios is essential in comprehending economic dynamics and potential market shifts. It allows market participants to make informed decisions based on the prevailing economic conditions, identifying risks and opportunities.

The Mechanics Behind Inverted Bond Yields

Analyzing the mechanics behind this economic indicator is essential in understanding the phenomenon of inverted bond yields. Two key factors play a significant role in the inversion of the yield curve: the actions of the Federal Reserve and the market’s expectations of future interest rates .

The Role of the Federal Reserve

The Federal Reserve , commonly referred to as the Fed, is the central banking system of the United States. The decisions and actions taken by the Fed have a profound impact on the overall economy and financial markets. One of the primary tools used by the Federal Reserve to manage the economy is the manipulation of interest rates.

By adjusting the federal funds rate, the interest rate at which banks borrow from each other, the Fed aims to control inflation , stimulate economic growth, and regulate financial stability. When the Fed believes the economy is overheating and inflationary pressures are rising, it tends to raise interest rates. Conversely, the Fed lowers interest ratin’ an economic slowdown or recession to encourage borrowing and spending.

The actions of the Federal Reserve directly influence the yield curve, which is a graphical representation of interest rates for bonds with different maturities. When the Fed raises short-term interest rates, it causes the yield curve to steepen, with short-term yields increasing more than long-term yields. This gradual increase in short-term yields relative to long-term yields can eventually lead to an inverted yield curve.

The Market’s Expectations on Interest Rates

In addition to the actions of the Federal Reserve, the market’s expectations of future interest rates play a crucial role in shaping the yield curve. Investors anticipate changes in interest rates based on various economic indicators , such as GDP growth, inflation , employment data, and geopolitical events.

When the market believes that interest rates will decline in the future due to economic uncertainties or sluggish growth expectations, long-term bond yields tend to fall. This decrease in long-term yields, coupled with the Federal Reserve’s ongoing efforts to normalize interest rates, can lead to an inversion of the yield curve.

The inversion of the yield curve occurs when short-term yields surpass long-term yields, reflecting market expectations of an economic slowdown or potential recession. It signals a lack of confidence in the future economic outlook and often serves as a warning sign for investors and policymakers.

In conclusion , understanding the mechanics behind inverted bond yields requires a comprehensive analysis of the Federal Reserve’s actions and the market’s expectations of future interest rates. Both factors contribute to the inversion of the yield curve, signaling potential economic challenges ahead. Investors and policymakers closely monitor these indicators to gauge the economy’s health and make informed decisions based on market conditions.

Historical Perspective on Inverted Yield Curves

A historical perspective requires a deep understanding of the relationship between inverted yield curves and recessions. By examining patterns that have preceded past economic downturns, we can gain valuable insights into the predictive power of these indicators.

Patterns Preceding Past Recessions

Throughout history, there have been several instances where inverted yield curves foreshadowed recessions. In many cases, a sustained period of yield curve inversion has served as a reliable signal that the economy is on the brink of a downturn. This pattern of signal-preceded action has been observed in multiple recessions, validating the importance of monitoring yield curve dynamics as a critical economic indicator.

One notable example is the inversion of the yield curve in the late 1970s, which preceded the severe recession of the early 1980s. Similarly, the yield curve inversion in the early 2000s was followed by the dot-com bubble burst and the subsequent recession.

The 1966 False Positive

While inverted yield curves have historically been associated with impending recessions, there have been cases where they provided a false positive signal. One example is 1966, when the yield curve inverted without a subsequent recession. This anomaly highlights the importance of considering other economic factors and indicators alongside the yield curve to generate a comprehensive understanding of the economic landscape.

Despite occasional false positives, historical patterns show a consistent correlation between inverted yield curves and recessions, making them an essential tool for economists and investors to assess the economy’s health and make informed decisions.

Assessing Recession Risks Post-Yield Curve Inversion

After a yield curve inversion occurs, economists closely analyze various factors to assess the risks of an impending recession.

One crucial indicator is the extent of the yield curve inversion. The severity of the inversion, measured by the difference between short-term and long-term bond yields, often provides insights into the potential depth of a recession. A more significant inversion suggests higher recession risks , while a less pronounced inversion may indicate a milder downturn.

Another aspect that economists consider is the duration of the yield curve inversion. A sustained and prolonged inversion is typically seen as a stronger recession signal. If the yield curve remains inverted for an extended period, it may indicate a heightened likelihood of a severe economic contraction.

Economists also monitor key economic indicators to gauge recession risks . Metrics such as unemployment rates, consumer spending, business investment, and manufacturing activity provide valuable insights into the economy’s overall health. If these indicators show signs of weakness and decline following a yield curve inversion, it may signify an increased probability of a recession.

Additionally, policymakers and central banks closely watch the financial markets and investor sentiment for clues about future economic conditions. Market volatility, credit spreads, and investor confidence can provide valuable information about recession risks . If market turbulence intensifies and investor sentiment turns pessimistic after a yield curve inversion, it may further heighten concerns about an impending recession.

By carefully analyzing these factors and considering the historical precedents of yield curve inversions, economists can provide insights into the probability of a recession and guide policymakers and investors in making informed decisions.

Inverted Bond Yields: Recession’s Alarms or False Signals?

As discussed in previous sections, inverted bond yields have long been considered potential indicators of impending recessions. However, evaluating their reliability and recognizing their limitations in recession forecasting is crucial.

Evaluating the Reliability of Inverted Yields

While inverted bond yields have historically preceded recessions, their accuracy as recession alarms varies. Several factors influence the reliability of inverted yields as recession indicators:

Limitations of Recession Forecasting

While inverted bond yields offer valuable insights, it is vital to acknowledge their limitations when predicting recessions:

It is essential to interpret inverted bond yields cautiously, incorporating them as part of a broader framework that includes other economic indicators and factors. Relying solely on inverted yields for recession forecasting may result in incomplete or inaccurate conclusions.

Inflation and Interest Rates: Interplay with Bond Yields

Inflation and interest rates play a crucial role in shaping the dynamics of bond yields. Understanding how these factors interact is essential for investors and economists to assess the economy’s overall health.

Federal Rate Hikes and Economic Impact

One key factor influencing bond yields is the Federal Reserve’s decisions on interest rates. When the economy grows steadily, and inflationary pressures build up, the Federal Reserve may raise interest rates to cool down the economy and prevent excessive inflation. This tightening of monetary policy affects the interest rates on various financial instruments, including bonds.

When interest rates are increased, the yields on newly issued bonds rise to attract investors. This upward pressure on bond yields can have several impacts on the economy:

Inflation Cooling and Yield Curve Implications

On the other hand, the cooling of inflationary pressures can also impact bond yields. Bond investors may demand lower yields when inflation expectations decrease as they anticipate lower investment returns.

This decrease in inflation expectations can affect the yield curve, which represents the relationship between bond yields and their respective maturities. In a cooling inflation environment, the yield curve may flatten or even invert as longer-term bond yields decline relative to shorter-term yields.

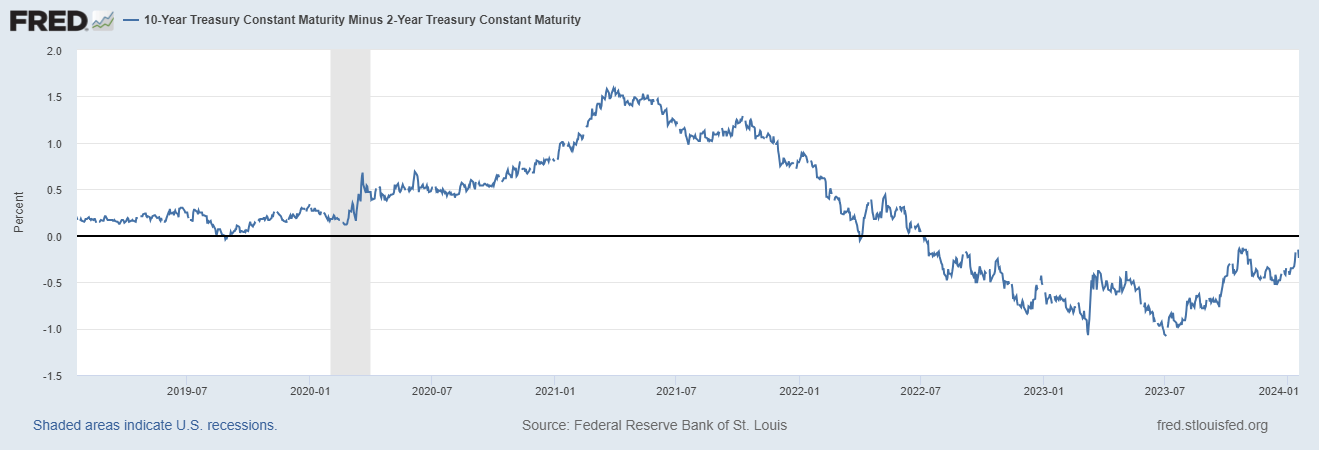

The image above illustrates how the yield curve may shift in response to the interplay between inflation, interest rates, and bond yields. Such changes in the yield curve slope can have important implications for investors, as an inverted yield curve has historically been associated with economic recessions.

Understanding the dynamics between inflation, interest rates, and bond yields is crucial for investors and policymakers in navigating the complexities of the financial markets and assessing the overall economic outlook.

Preparing for an Economic Downturn

To navigate an economic downturn successfully, it is crucial to have a solid financial strategy in place. By preparing for potential challenges, individuals can enhance their financial stability and minimize the impact of a recession. This section will discuss practical strategies for personal financial stability, including the importance of emergency funds and reducing debt .

Strategies for Personal Financial Stability

1. Build an Emergency Fund: One of the most critical steps to prepare for an economic downturn is establishing an adequate emergency fund. This fund should ideally cover three to six months of living expenses and be easily accessible. By having a financial safety net, individuals can avoid unnecessary debt and navigate challenging times more confidently.

2. Prioritize Debt Reduction: Reducing debt becomes even more crucial during times of economic uncertainty. Start by paying off high-interest debts and focus on clearing outstanding balances. By alleviating financial burdens, individuals can position themselves for more excellent stability and flexibility when faced with economic challenges.

3. Trim Unnecessary Expenses: Review current expenditure patterns and identify areas where spending can be reduced. This might include cutting back on discretionary expenses, negotiating better deals for essential services, or finding ways to save on everyday items. Redirecting these savings towards emergency funds or debt repayment can help secure a stronger financial position.

4. Diversify Income Streams: Multiple income sources are essential in a recession. Consider exploring part-time or freelance opportunities that align with existing skills or interests. Diversifying income streams can provide an additional layer of security during challenging economic times.

Emergency Funds and Reducing Debt

Building an emergency fund and reducing debt are critical pillars of financial stability during an economic downturn. With an emergency fund, individuals can handle unexpected expenses or interruptions in income without resorting to high-interest debt. Simultaneously, reducing debt minimizes financial burdens and allows individuals to maintain better control over their finances.

Remember, these strategies are proactive measures to strengthen financial resilience. By implementing them, individuals can better protect themselves and their families from the potential impact of an economic downturn.

Investment Strategies Amidst Yield Curve Fluctuations

When navigating the uncertain terrain of yield curve fluctuations , it is crucial to implement effective investment strategies that can help protect and grow your portfolio. By understanding the potential risks and opportunities associated with these fluctuations, investors can make informed decisions and position themselves for success.

Inverted Bond Yields, Recessions: The Current Scenario

The current scenario regarding inverted bond yields and recessions is paramount in understanding the economic landscape. Recent developments in the market have raised concerns and have the potential to impact the economy significantly. We have had a continuous Inverted bond yield from July 6, 2022, through January 17, 2024.

According to data from the Federal Reserve Bank of San Francisco, an inverted yield curve has accurately foreshadowed all ten recessions since 1955. The U.S. Treasury yield curve is a go-to gauge for many seasoned investors regarding economic forecasts.

One primary concern is the inverted yield curve, which occurs when long-term bond yields fall below short-term bond yields. This phenomenon has historically been associated with economic downturns and is a warning sign for potential recessions.

Government Bonds and Their Role in Economic Forecasting

Government bonds play a crucial role in economic forecasting , providing valuable insights into market dynamics and shaping economic expectations . By analyzing the behavior of government bonds during market downturns, economists can gain a deeper understanding of the prevailing economic conditions and project future trends.

Analyzing Government Bond Behaviors During Market Downturns

During market downturns, government bonds often exhibit distinct behaviors that reflect investor sentiment and risk appetite. These behaviors can provide critical clues about the overall state of the economy and its resilience to financial shocks. For instance, investors tend toward government bonds as safe-haven assets when pessimistic about the economic outlook. This increased demand drives bond prices up and yields down, creating a characteristic inverse relationship between bond prices and market performance.

Moreover, the yield curve of government bonds, which plots the bonds’ yield against their respective maturities, can offer valuable insights into market expectations . The shape and movement of the yield curve during a market downturn can signal investor sentiment regarding future economic performance. For example, a flattening or inversion of the yield curve may indicate expectations of a potential economic slowdown or recession.

Economists can make informed predictions about the economy’s direction and potential impact on various sectors and financial markets by closely analyzing these bond behaviors during market downturns.

How Government Bonds Reflect Economic Expectations

Government bonds are closely tied to economic expectations due to their role as credit risk indicators and the economy’s overall health. When economic expectations are positive, government bonds typically experience lower yields as investors prioritize higher-yielding assets. Conversely, government bond yields tend to rise during economic uncertainty or pessimism as investors seek safer investment options.

Government bond yields also reflect the anticipated future path of interest rates. Central banks, such as the Federal Reserve in the United States, influence short-term interest rates, which, in turn, affect the yields of government bonds. When the central bank raises interest rates to combat inflation or cool down an overheating economy, government bond yields may also increase, reflecting the higher cost of borrowing.

Overall, government bonds serve as barometers of economic expectations, offering valuable insights into investor sentiment, credit risk, and future interest rate movements. Economists can make more accurate forecasts and guide policy decisions to support economic stability by analyzing these bond behaviors and their relationship to economic expectations.

Conclusion

In light of the concern raised by an inverted yield curve—an event renowned for its historical tendency to foreshadow economic downturns—it’s imperative for retirees to proceed with the utmost caution in managing their investments. The appearance of this phenomenon is a manifest reflection of prevailing investor trepidation and forward-looking expectations. As such, it demands a heightened vigilance in observing economic indicators and perhaps necessitates a prudent reassessment of investment approaches.

For those dependent on their retirement savings, it’s particularly crucial to prioritize stability and safeguard against the potential fiscal tumult that recessions may inflict. In this vein, fixed index annuities stand out as a stalwart option, providing a bulwark against market volatility. These vehicles offer a dependable income stream, with the return potential tethered to a market index but without the attendant direct market risk – a bastion of security in inclement financial climates.

It is worth noting, however, that an inverted yield curve is but one tool in the analytical arsenal and should not be the lone guiding star in navigating investment decisions. Although historical concurrence exists between yield curve inversions and economic recessions, it is critical to understand that this correlation does not equate to causation. Prudent investors and analysts should survey a broad tableau of economic indicators to form a more comprehensive view of the impending financial landscape.

I cordially invite you to contact Carolina Benefits Group for a complimentary consultation to explore the full array of conservative investment avenues that may suit your retirement strategy. We aim to illuminate a path that aligns with your aspirations for a secure retirement, taking into account the unique intricacies of your financial picture.

Source Links

Contact Us

We will get back to you as soon as possible.

Please try again later.

©2024 All Rights Reserved | Carolina Benefits Group | Privacy Policy